Market leading provider of working capital finance

Investors in state-of-the-art credit assessment and risk technology to support rapid global expansion

- 400 Employees

- Founded 2011

- Headquartered London

- 8M Customers

- Across 60 Countries

The Challenge

To create end-to-end automation and global scalability for the organisations origination, client onboarding, distribution and risk management processes with world-class controls.

A leading non-bank provider of working capital finance to companies globally. The firm focuses on the monetisation of future cashflows for clients by financing both short-term instruments, such as trade receivables, through to long-dated contracts.

The organisation was founded in 2011 and has grown to 400 people around the world comprising the brightest talent in the global finance industry.

Rapid business growth, and a clear strategic vision, drove the decision to invest in next generation risk management technology to support high volumes, high levels of automation and a robust control environment.

CubeLogic was chosen as their technology partner due to its unique ability to combine sophisticated credit application workflows with credit risk and portfolio management analytics. They also valued the proven flexibility, on-the-fly analytical and reporting architecture, integration possibilities and superior workflow tools integral to RiskCubed.

Another key factor in their decision was CubeLogic’s ability and willingness to work with internal and external parties in a true partnership framework.

The Vision

The vision was to adopt a strategic risk management platform and enable full integration into their wider internal IT infrastructure.

After a rigorous evaluation process, CubeLogic’s RiskCubed enterprise risk platform was selected and they embarked on a rapid incremental implementation process.

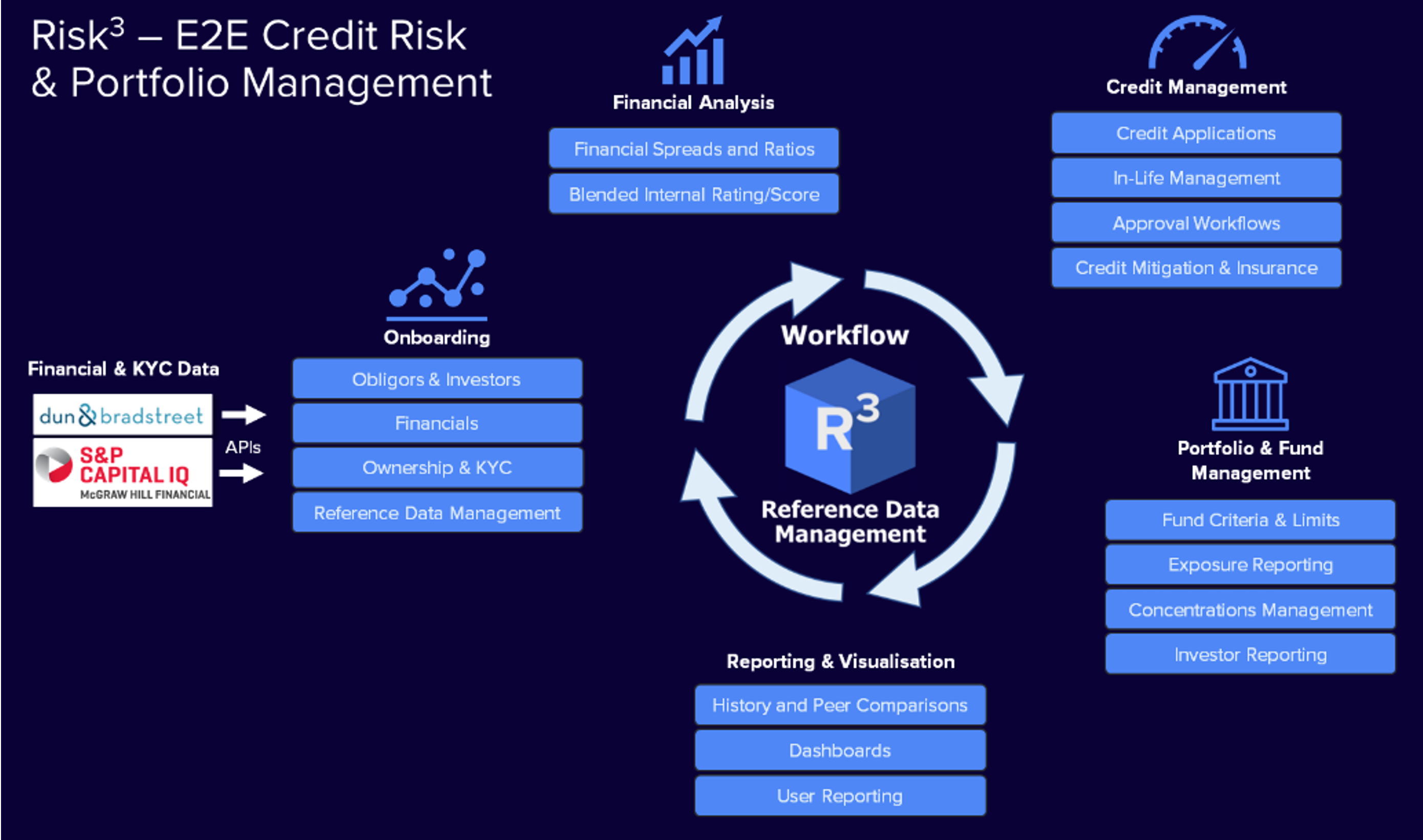

The Scope

- Client onboarding and KYC

- Reference and financial data

- Financial analysis

- Credit applications, approval workflows

- In-life management

- Credit mitigation and credit insurance

- Exposure reporting

- Concentration management Investor reporting

- Reporting and visualisation

The Phases

- Automated client onboarding with retrieval and storage of golden source data.

- APIs to DnB and Capital IQ

- Streamlined processes for; Agreement in Principle to Credit Application and Approval

- Exposure aggregation & limit management

- Portfolio management and concentration reporting

- Workflows: in-life management, first payment certificate, Chinese walls

Outcomes and Benefits

The company now has fully automated its origination, client onboarding, distribution, limit and exposure management, and risk oversight processes. This has provided significant efficiency gains, enabling rapid business expansion whilst simultaneously enhancing controls adequacy and effectiveness.

Key Benefits include;

- Short implementation timeframe

- Simplified risk IT architecture and removal of manual processing

- IT infrastructure that scales with business growth; high automation

- Self-service on-the-fly reporting and analytical capabilities

- Elimination of redundant manual processes

- Improved Business Intelligence and greater risk management insight

- Less time spend gathering data and more time spent analysing it