Collateral Optimization for EDF Trading

Case Study: RiskCubed Solution Creation of a single Platform for Collateral Management

Workflow customization for single platform creation

About the Client

EDF Trading is global, asset-backed, and operates from source to supply wholesale power, natural gas, oil, LPG, environmental products, and LNG. They have been a client of CubeLogic and its software RiskCubed for about a decade. The firm was founded in 1999 and has grown to around 700 people all over the world comprising the brightest talent in the global energy industry.

The Benefits

Allowed the treasury team to reduce processing time for margin calls significantly

• Its integration within the RiskCubed toolset allows for flexibility without

compromising security, speed, and reliability.

• Migration of collateral approval to RiskCubed results in a streamlined process

with full archive functionality.

• Enabled the treasury team to manage payments and receipts for all collateral

types in a single dashboard due to full integration with external payment

providers and ledger systems

The Challenge

EDFT were looking to expand the scope of usage of the RiskCubed solution through the consolidation of their collateral management onto a single platform. This would involve the incorporation of approval processes and security controls without impeding the existing margining processes. Furthermore, this consolidated system would need to interact with external payment providers and ledger systems thus requiring robust failsafe mechanisms. The project was successfully completed during a time of incredibly high-margin activity. Integration of payment and journal systems to create an end-to-end automated solution for margining and collateral for RiskCubed at EDF Trading.

Software Choice

CubeLogic was chosen as their technology partner due to its unique ability to combine

sophisticated credit application workflows with credit risk and portfolio management analytics.

The Scope

- Improve current margining process with workflow enhancements

- Integration of LC fee module

- Integration of margin interest module

- New workflows to handle payment details and approval processes

- New interface to handle payment and journaling entries for margining, margin interest, LC fees and cash collateral

The Vision

The vision was to adopt a strategy of customizing existing workflows to allow further integration of collateral management onto a single platform. Since EDFT was already using RiskCubed over the years, it was decided to create this as it’s extension.

The Outcomes

- Faster processing of margin calls

- Tracking and payment of LC fees are all handled within RiskCubed

- LC and collateral workflows streamline approval processes

- Archive of previous requests available in one location without the need for email backtracking

- Seamless integration with external payment and ledger systems

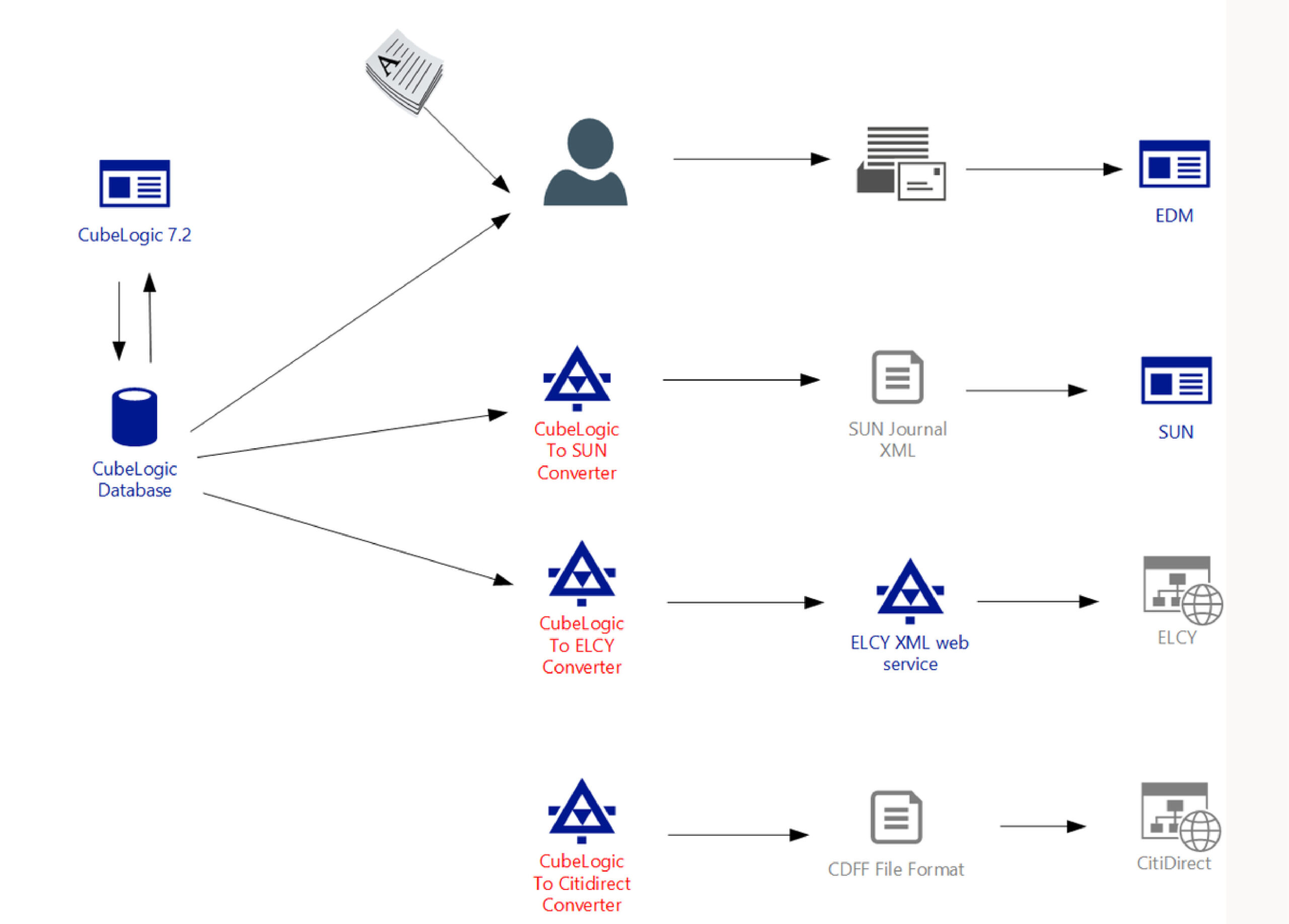

Before Implementation

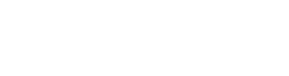

After Implementation