End-to-End Credit Insurance Platform

Enhance credit evaluation, automate underwriting, streamline risk assessment, optimize policy management, and easily manage claims, all on one platform.

Our Service

The new standard in credit risk management

CubeLogic is enabling Trade Credit and Surety Insurers to modernize their onboarding process with a platform that enhances underwriting and provides superior insights on credit and market risk exposure. Our platform helps design proposals, keep your customer knowledge base up to date, and can create the in-depth analysis needed to quickly create a policy. Our platform offers custom tailored delivery with easy configuration.

Credit Insurance Solution

Streamline Underwriting

- Automate and Customize Workflow

- Advanced Credit Scoring Accuracy

- Timely in-depth credit evaluation

- Portfolio Analytics and Concentration Reporting

Surety Solution

- Integration with back-office systems

- Reduces the cost of processing surety bonds

- Advanced accuracy and loss avoidance

- Manage risk with in-depth, accurate data

- Documentation Management

AUTOMATE AND STREAMLINE YOUR UNDERWRITING AND ONBOARDING PROCESS

Provide clients service quickly by cutting your underwriting evaluation time in half. Use Client and Risk centric methods to evaluate each client individually and take on the risk that makes sense for your business.

INCREASE CREDIT SCORING ACCURACY

The CubeLogic platform provides enhanced credit scoring and pricing capabilities of trade credit and surety insurers. Using several different methods of evaluation means that scoring is more precise, ensuring less exposure.

IN-DEPTH CREDIT AND MARKET RISK EXPOSURE INFORMATION

Leverage real-time updated data from multiple sources to develop innovative risk assessment models. Our approach streamlines decision-making processes, enabling more accurate and informed risk evaluations.

Configuration

Custom Tailored to Your Needs

Our platform offers custom tailored delivery with easy configuration. With a variety of modules and views to choose from, the data you need to make underwriting decisions is always at your fingertips.

Operational Benefits

Increase Staff Capacity

Automated processes contribute to lower underwriting expenses and frees up valuable staff time for other business tasks, lowering administrative needs.

Case Study

Customer Success Story

Ascot collaborates with CubeLogic to enhance their insurance management system, enabling customer onboarding, risk assessment, and streamlined broker interactions while optimizing operations through automation.

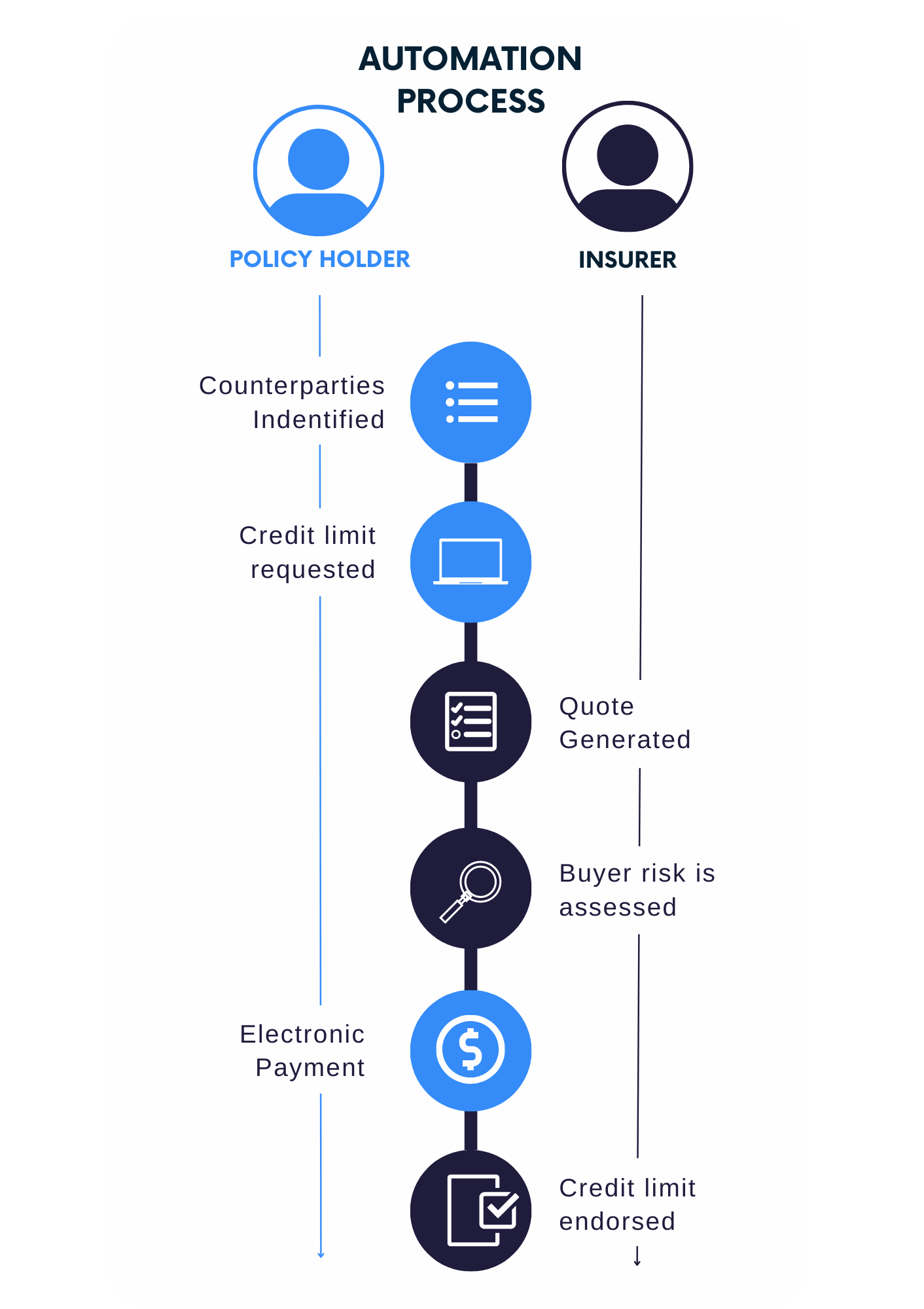

How it Works

Automated Process

Highly Streamlined and Accurate

Create a workflow and highly streamlined process for assessing and managing credit risk. By utilizing automated tools for data gathering and analysis, credit insurers can make informed decisions in a timely manner. With a clear sequence of steps and decision points, the workflow provides a structured framework for credit insurers to minimize risk and maximize profitability in their operations.

Latest CubeLogic News

US-style Position Limits Are Coming to the UK! – What Do You Need to Know?

In a recent consultation [1] the Financial Conduct Authority (FCA), the UK financial market regulator, proposed an extensive overhaul of the UK’s regulatory position limit regime. The new rules, if implemented, would bear some resemblance to the current US Federal...

CubeLogic Exhibits at Global Trade Review (GTR) US Conference

The CubeLogic trade credit insurance team was thrilled to sponsor and attend the GTR US conference this winter. This event was of particular interest to our team because GTR offered the latest insights into emerging trends and opportunities at the intersection of...

CubeLogic Attends Adipec Conference

Natallia Hunik, Chief Revenue Officer, represented CubeLogic at the prestigious Adipec (Abu Dhabi International Petroleum Exhibition & Conference) this fall. Adipec is one of the largest and most influential events in the global energy calendar, bringing together...