US-style Position Limits Are Coming to the UK! – What Do You Need to Know?

In a recent consultation [1] the Financial Conduct Authority (FCA), the UK financial market regulator, proposed an extensive overhaul of the UK’s regulatory position limit regime. The new rules, if implemented, would bear some resemblance to the current US Federal position limit regime and would introduce many of the compliance challenges experienced by firms exposed to it.

Overview

With the UK being one of the largest commodity markets in the world and home to several large energy and commodity exchanges, including ICE Futures Europe and the London Metals Exchange, this development should be of interest to any firm actively trading on these venues as well as in related OTC contracts.

The current UK regime is a legacy of MiFID II dating back to 2018 before the UK officially left the EU. The UK regime was largely rolled back in 2021 when the FCA announced [2] that it would not take enforcement action against firms in breach of UK MiFID II position limits unless the contract was cash-settled or an agricultural commodity, adding to a 2020 exemption [3] for liquidity providers. The latest proposal builds on an earlier consultation from HM Treasury [4] in 2021, adding more detail to the proposal along with several new concepts.

Below we touch on some of the aspects of the proposed regime.

Scope

The new regime will focus on a narrower set of “Critical” contracts which will be determined by the FCA. Critical contracts will comprise of physically settling contracts only. Such contracts are comparable to the 25 Core Referenced Futures Contracts (CRFCs) under the Dodd-Frank position limits regime, with a key exception that the limits themselves will be set by the exchange, rather than by the authorities. The FCA intends to maintain a register of Critical contracts and have proposed a set of criteria which will determine which contracts indeed qualify as critical. The criteria will include:

- The settlement method at expiry (i.e. Physical vs Financial);

- The size of the commodity derivative market compared to the underlying physical commodity and the robustness of the reference price used to settle contracts;

- The type of underlying and the impact on end-users;

- The size of the market.

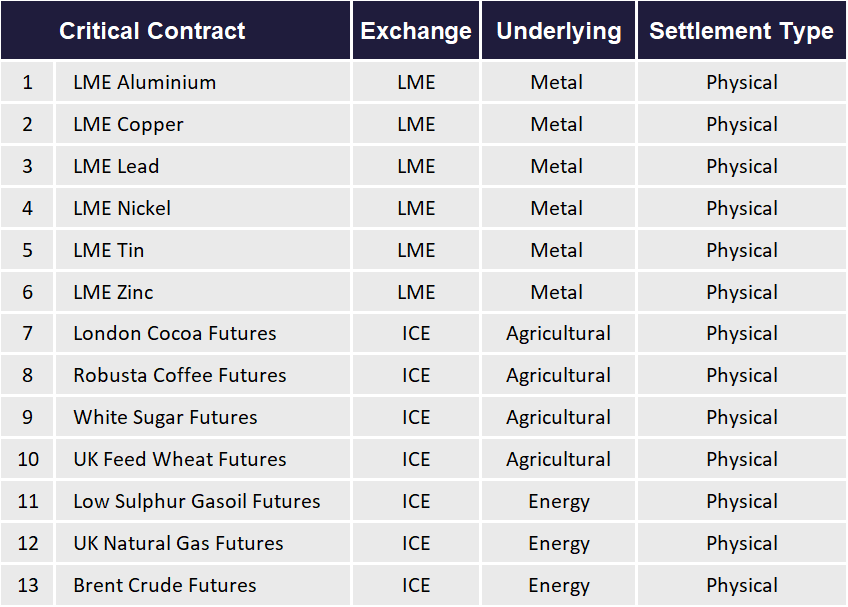

The consultation proposes a total of 13 Critical contracts (see table below), comprised of six metals contracts, four agricultural contracts and three energy contracts. The FCA points out that the ICE T-West Texas Intermediate (WTI) Light Sweet Crude Futures is considered a Critical contract despite it being cash-settled. They have declined however to propose the assignment of its own position limit stating that it will likely be captured as a “Related” contract (discussed below).

Table 1: Proposed critical contracts subject to consultation response.

Along with Critical contracts, the new position limit regime will also include so-called “Related” contracts. Related contracts are any commodity derivatives traded on a UK exchange whose settlement price is directly or indirectly linked to the settlement price of a Critical contract. This would also include any commodity derivative, such as options or spread contracts, which result in a position or delivery obligation in a critical or related contract on settlement or expiry.

Related contracts may be considered analogous to “linked contracts” under the US Dodd-Frank position limits regime. In a key difference to the US regime however, the FCA proposes that the exchanges themselves would be required to identify and publish a list of such contracts in a “a clear and accessible manner”. This approach will be welcomed by those with experience with US Dodd-Frank position limits where, while an initial workbook for linked contracts was published by the CFTC, the responsibility for identifying these contracts on an ongoing basis rests with the market participant.

At a minimum, Related contracts will include options on Critical and Related contracts, mini contracts, Balmos and mini-Balmo contracts, inter-contract spreads that include a Critical contracts and cash settled look-alike contracts that are linked to the Critical contract.

Finally, and again following the US model, the FCA proposes that exchanges should set “accountability thresholds” as a position management control. Accountability thresholds are viewed by many as “soft limits” and, under the FCA’s proposal, will apply to both Spot and Other months position limit periods (see below). When such soft limits are breached, the exchange would monitor the position more closely and, when required, would have the ability to compel the market participant to reduce the position.

Setting Position Limits – Structure and Approach

In terms of position limit structure and the approach to setting such limits, the FCA proposes moving away from the “fixed baseline threshold” approach introduced under MiFID II, opting instead for a more bespoke, dynamic approach.

The task of setting limits will be pushed to the exchanges who will be required to consider many of the factors specified under the MiFID regime, with some key additions such as market liquidity and the ability for market participants to unwind their positions. The thinking for the latter extends from the LME Nickel market event [5] in March 2022 where disorderly unwinds caused a significant amount of market disruption. Key however is that the FCA expects the exchanges to set both Spot and Other months limits. This again is a key departure from the US Dodd-Frank position limits regime where only Spot limits apply with the exception of limits for several legacy agricultural contracts.

The FCA also opens the possibility for the exchanges to set multiple limits within specific limit periods. This would follow a similar approach the Dodd-Frank regime where, for example, multiple so-called “step-down limits” apply to the WTI CRFC during the spot window as the contract approaches its last trading date.

Exemptions from Position Limits

The FCA also proposes several changes to the position limit exemptions regime. They propose, in a departure from the MiFID regime, that the exchanges assume responsibility for granting exemptions – removing the responsibility (and the workload!) from the FCA who are currently responsible. Exchanges would be required to notify the FCA when exemptions are granted and would be required to provide an annual report summarising exemptions from across the year.

While exemptions will not be bound by time limits, market participants will need to inform the exchange of any significant changes to the information originally provided for the exemption so that they may reassess the ongoing validity of an exemption. Exchanges will also be compelled to consider “exemption ceilings”. Exemption ceilings will limit the size of the exemption that may be claimed in certain circumstances. Should market participants breach the ceiling, additional exchange reporting requirements would kick in and, in some situations, the exchange would also be granted additional position control powers.

Before granting exemptions, exchanges would need to consider the ability of the market participant to unwind its position – again, a requirement borne from the March 2022 LME incident.

Finally, two further exemption categories are proposed by the FCA. The first is the granting of so-called “pass-through hedging exemptions” which would allow financial firms who offer hedging products to non-financial firms to claim exemption from position limits for such positions. Until now, exemptions have only been available to non-financially regulated entities. Again, this approach lends from approach applied under the US Dodd-Frank position limits regime.

The second is an explicit exemption for firms providing liquidity to the market. The market participant must however participate in a bona-fide liquidity provider scheme set-up by the exchange and firms should not draw on the exemption for longer than absolutely necessary when providing liquidity.

Position Reporting

The FCA proposes the establishment of a position reporting regime which would require exchange members and their clients, up to and including the end client, to report their positions to the exchange. The FCA have avoided being overly prescriptive with regards to the specifics of this regime proposing a risk-based approach in determining scope and setting out criteria, which if met, may trigger additional reporting requirements. An example trigger might include when a market participant’s aggregated position in Critical and Related contracts is equal to or larger than the relevant accountability threshold.

The proposed reporting rules include additional reporting requirements for related Over-the-Counter (OTC) contracts and derivatives traded on overseas trading venues. The principles applied to identifying Related contracts would be extended to both of these types of contracts.

Interestingly, the FCA proposes that exchanges again be made responsible for identifying both of the above contact types akin to their obligations around identifying Related contracts. It is not precisely certain what the FCA has in mind in this regard. OTC contracts are typically decentralised in nature and exchanges have limited oversight of such activity. Market participants also have limited obligations in reporting OTC contracts, some of which do not necessarily fall into scope of the MiFID II and/or EMIR reporting regimes. The consultation responses from the market will no doubt stimulate deeper inquiry in this respect.

Will the EU Follow suit?

While the EU appears to have lost its appetite for commodity derivative position limits after the overly ambitious scope of MiFID II, they are purportedly expected to revisit the topic again in 2025. It is far too soon to understand what approach, if any, the EU authorities might take. While home to exchanges such as ICE Endex, EEX and Euronext which list many significant commodity contracts, the removal of the UK venues from scope might have lowered the priority of this topic in the eyes of EU lawmakers. That said, the EU’s appetite for invasive market measures such as the Market Correction Mechanism [6] implemented for TTF gas suggests that this topic won’t stay off the table for very long.

Conclusion

With a few exceptions, the FCA is proposing a pragmatic and well-balanced position limit regime arguably taking the best elements from the US and EU regimes and adapting them for the UK’s commodity markets. While time will tell how many of these proposals make it into the final rule set, firms trading on UK-based exchanges should begin to consider the potential requirements necessary to both manage and monitor aggregated Critical and Related contract positions. They should also consider the potential position reporting requirements, particularly for Related overseas exchange traded contracts and OTC contracts. It is not clear when the new, final rules will come into force firms should probably plan for the latter stages of 2024 or early 2025.

Links

1] https://www.fca.org.uk/publication/consultation/cp23-27.pdf

2] https://www.fca.org.uk/news/statements/statement-supervision-commodity-position-limits

3] https://www.fca.org.uk/publication/documents/supervisory-statement-mifid-end-transition-period.pdf

5] https://www.lme.com/en/trading/initiatives/nickel-market-independent-review